Keyword research is an integral part to my process of doing SEO for B2B clients. However, it is really easy to fall into the rabbit hole of over-researching and ending up with a spreadsheet of 10K+ keywords that are impossible to create content for.

At the end of the day, keyword research should accomplish only two primary goals:

- Help you know exactly what keywords to target

- Provide you with data for content prioritization

In this post, I’m going to show you how to do B2B keyword research with Ahrefs & SEMRush and the ultimate keyword research tool to have ever existed: Google.

Why do you even need B2B keyword research?

The conventional process of doing keyword research looks like this:

- Use keyword research tools (Ahrefs/SEMRush) to generate a huge list of potential keywords.

- Sift through thousands of potential keywords to find the ones relevant to your business and your content strategy.

Sometimes it is really tempting to not do keyword research and just go straight to content ideation and planning. If I know a lot about my industry, and I know exactly what I want to write, what’s the point of conducting a time-consuming keyword research phase?

Personally I think there are two critical benefits to keyword research:

- It organizes your content production. Without data on keyword volume and keyword difficulty, your content plan is just guesswork. You may risk going after keywords that nobody searches or keywords that are incredibly difficult to rank for.

- Keyword research tools are incredibly useful when it uncovers terms and ideas that you never knew to exist in the first place.

Example of how to do keyword research for a B2B SaaS company

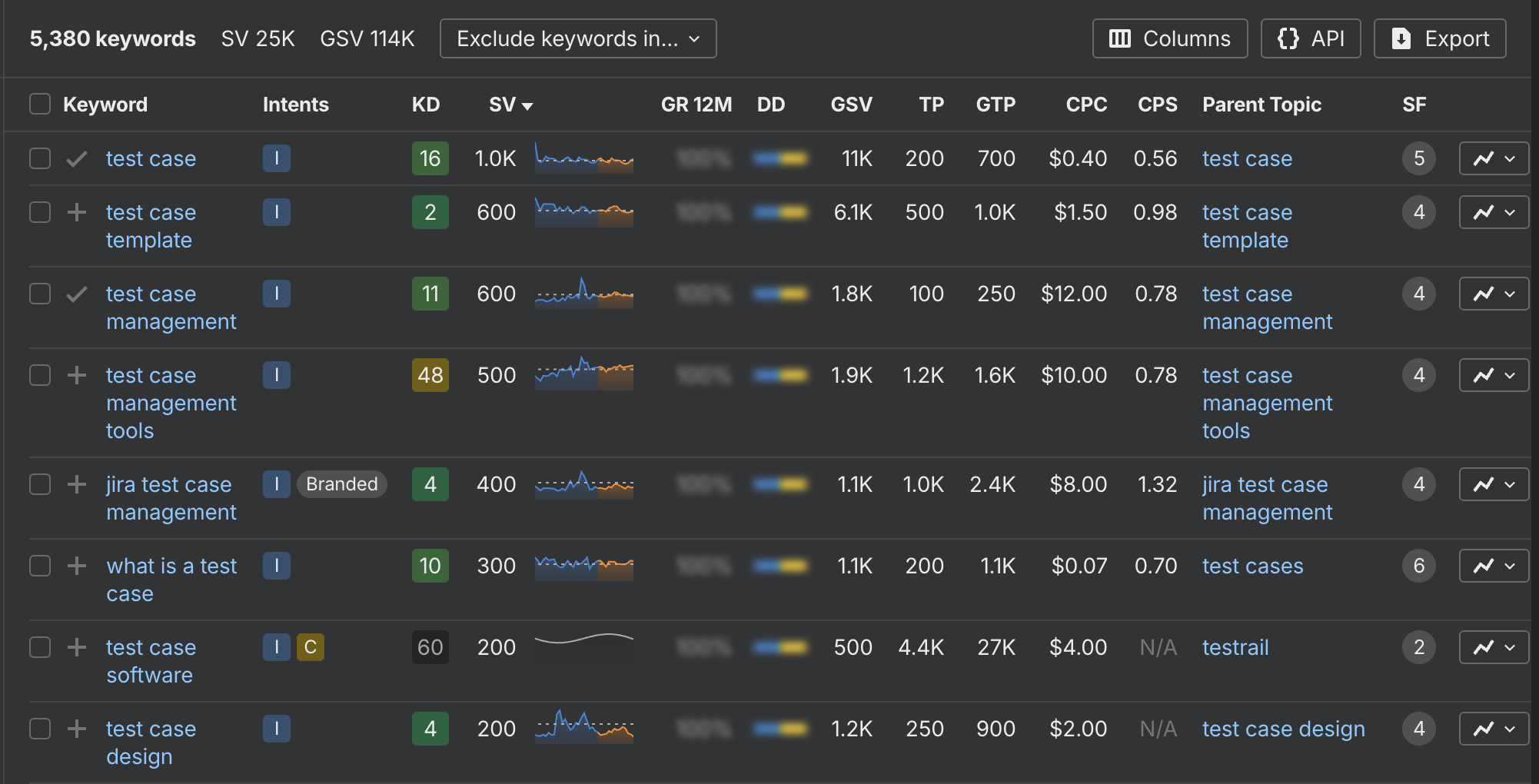

For example, when I was doing keyword research for Katalon, I simply type into Ahrefs the keyword “test case”, which is one of the major topics that we are going after.

Ahrefs returns with a list of really fascinating keyword ideas like:

- test case template

- test case management

- test case management tools

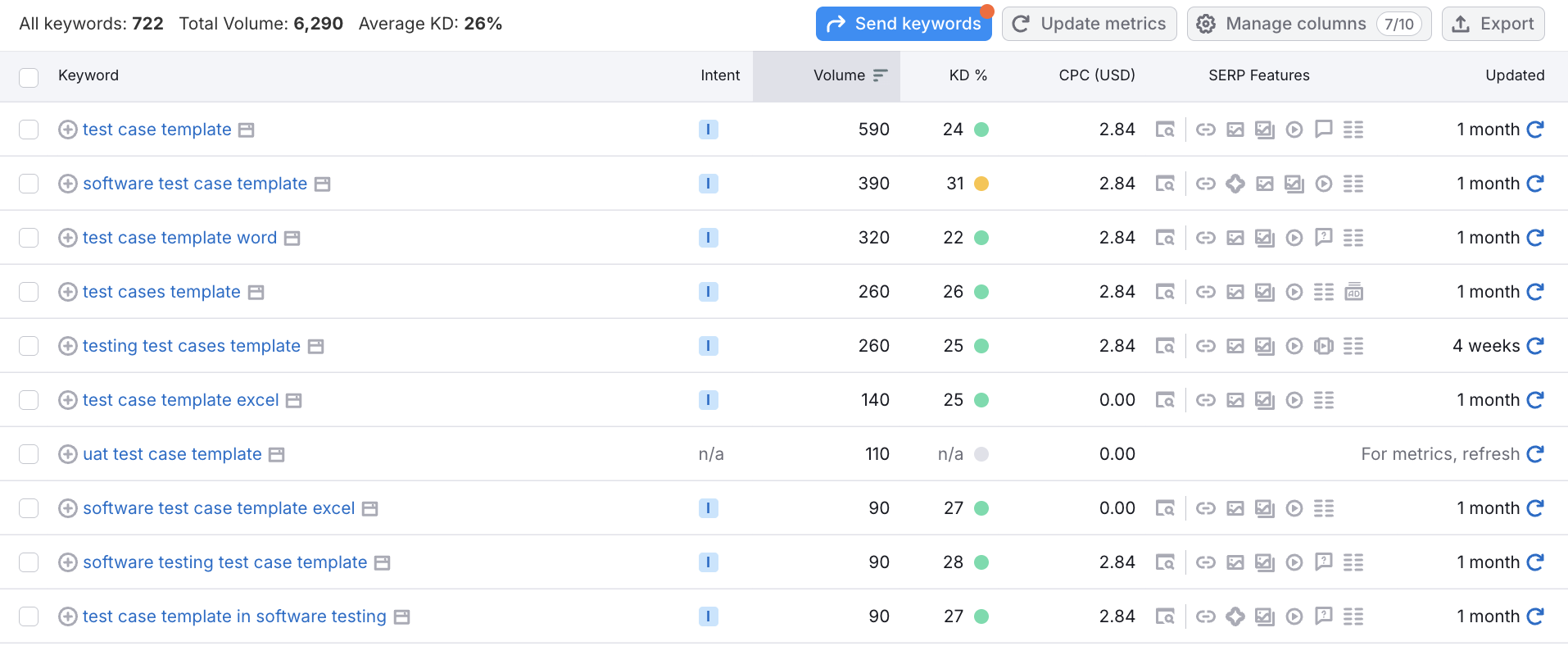

When I dive one step further to the “test case template” keyword (using SEMRush), I realize that there is a very real and persistent demand for test case templates that testers can download and use in their day-to-day work, and we can create content to serve that demand:

After some digging around, I discover another underserved topic: test cases for [thing to be tested], such as:

- sample test cases for software testing

- test cases for login page

- test cases for uat

- test cases for black box testing

- test cases for functional testing

- test cases for shopping cart

- api test cases to get request

They all have pretty decent volume (50-200 monthly searches) and really low keyword difficulty (15-30% per SEMRush standard). That means these keywords have:

- Decent demand for content (people want to search for sample test cases for certain use cases)

- Low competition (not enough brands/big fish are creating such types of content)

That’s my chance to create content and capture that market share.

In other words, keyword research is so much more than just a content planning phase. It helps gauging the market. For startups and small brands, these decent-volume low-competition keywords are worth more than gold. It helps them place their first imprints in the vast world of Google.

When I look at what people are actively searching for in the niche, I also gain insights into their behavior, pain points, issues, and underserved content needs.

Most importantly, keyword research also helps me prioritize content production. Out of all “test case template” keywords, what keywords should I prioritize? That’s when I look at the Keyword Difficulty of each keyword to find the low-hanging fruits (0-29% difficulty by SEMRush standard). Go for the easy ones first, difficult ones after.

Need a B2B SEO agency to help? Here are 20 Best B2B SEO Agencies You Should Know

My process of doing B2B keyword research

Step 1. Know where keyword research belongs to

As an entrepreneur, I love SEO. It is the perfect channel to build your brand when you don’t have a million dollar (yet) to run fancy ads. However, SEO content usually has a bad rep of being “bland” and “written for the machines, not humans”. And I totally understand.

In fact, I believe that you must go beyond beyond SEO to do successful B2B content marketing.

As part of my approach to B2B content marketing, I always advocate for a balance between SEO and non-SEO content, or the Knowledge content and Narrative content. Here’s how they differ:

| Attribute | Knowledge Content | Narrative Content |

|---|---|---|

| Purpose | Evergreen, utility-driven content designed to help users solve specific problems, make decisions, or learn something critical. | Timely, trend-based content that shares perspectives, company news, or thought leadership around current industry events. |

| Searchability | Optimized for search and discoverability. Structured around user queries, long-tail keywords, and high-intent topics. | Less optimized for SEO; relies more on direct distribution via social media, newsletters, or brand followers. |

| Longevity | Designed to remain relevant over time with minor updates. Content ages well and continues to generate value. | More ephemeral. Content is tied to a moment in time and may lose relevance or impact as trends shift. |

| Format | Guides, explainers, playbooks, tutorials, how-tos, and solution-focused content hubs. | Blog posts, opinion pieces, editorial commentary, interviews, and industry reactions. |

| Navigation | Topic- or category-based structure. Prioritizes discoverability over time, not recency. | Chronological feed. Latest content comes first, older content fades in visibility. |

| Value to the Business | Builds long-term acquisition, organic traffic, and self-serve education. Scales over time. | Drives thought leadership, brand equity, and engagement. Stronger in brand-building than in demand gen. |

| Measurement | Tracked by organic traffic growth, time on page, conversion assist, and long-term performance. | Measured through clicks, opens, social engagement, and recency-based traffic spikes. |

Keyword research belongs to the Knowledge part in this strategy. It directs your SEO-led content creation efforts.

I always recommend SEO content, but you should also allocate some of your efforts to writing your Publication content too.

Step 2. Know what type of keywords to target

When running SEO keyword research for B2B companies, I typically separate search terms into two distinct categories:

1. Commercial Keywords

These are search terms that signal high buying intent. They’re the queries people use when they’re looking for a specific solution, vendor, or offering, such as:

- best cloud testing platform (best of keywords)

- Zendesk vs Freshdesk (competitor keywords)

- HubSpot alternatives (alternative keywords)

- test automation tool for fintech (tool keywords)

- Zendesk cost (pricing keywords)

2. Pain-point Keywords

These keywords help your target audience solve a certain problem/pain point they’re having. Pain point keywords are inherently more problem-oriented, making them ideal for blog content, guides, and learning hubs:

- how to automate regression testing

- how to set up end-to-end testing in CI/CD

- choosing the right test automation framework

- how to reduce flakiness in UI tests

- when to use codeless test automation

- how to test mobile apps across devices

I don’t really recommend chasing Informational keywords. There are 3 reasons for that:

- Informational keywords usually attract the wrong kind of traffic. These searchers are usually in research or curiosity mode, not necessarily problem-aware. While these terms can totally generate traffic, they don’t always drive qualified leads, and in many cases, they end up bloating vanity metrics (sessions, impressions) without contributing meaningfully to revenue.

- Informational search terms are heavily saturated. Every SaaS blog, affiliate site, and AI content farm is competing for these. Most SERPs are dominated by high-authority domains (HubSpot, IBM, G2, Wikipedia), and it’s meaningless to go against these Goliaths (we’re not Davids, unfortunately)

- AI Overviews are taking care of those queries. With Google’s AI Overviews, many of the classic informational queries are now instantly answered by AI summaries right at the top of the search results. Users often don’t click through. That means even if you rank #1, you might get zero clicks.

Step 3. Start with customer research

I usually start my keyword research with an Audience Mapping table where I map the pain points of potential buyers with the solutions my clients provide.

In an Audience Mapping table, I usually have these columns:

- Buyer Type (are they Practitioner or Decision maker?)

- What is their Job Title?

- What are their pain points?

- Map their pain points with their solutions

- (Optional) Weighting for the relative importance of that buyer persona

- Content topics

It can look like this:

| Buyer Type | Role/Title | Key Pain Points | Our Solution | Weighting | Content Topics |

|---|---|---|---|---|---|

| IC/Practitioner | QA Engineer | Repetitive manual test cases; flakiness in automated tests; limited CI/CD integration | Low-code test creation, stable automation framework, and native CI pipeline support | 35% | “How to reduce flaky tests with smarter locators”; “Integrating automation into CI/CD” |

| Mid-level Decision Maker | QA Manager / SDET Lead | Scaling test coverage; maintaining test scripts across versions; slow test execution | Parallel testing, version-aware object management, reusable test suites | 20% | “How to scale automated testing without hiring more testers”; “Managing test debt in growing teams” |

| High-level Decision Maker | Director of Engineering | Delayed releases due to QA bottlenecks; dev-QA misalignment; rising QA costs | Unified QA platform with analytics, dashboards, and cross-team visibility | 7% | “How to eliminate QA bottlenecks in release cycles”; “Cost-benefit analysis of test automation platforms” |

| Executive Stakeholder | VP of Product / CTO | Pressure to accelerate delivery while ensuring app quality; legacy tools not scaling | Enterprise-grade automation with ROI dashboards, scalability, and migration support | 3% | “How test automation accelerates go-to-market”; “When to migrate from Selenium to a modern platform” |

Step 4. Actually do keyword research

From this table, here’s how I do keyword research:

- Come up with several seed keywords for a certain topic based on your Audience Mapping

- Reverse-engineer Google to uncover what are being ranked

- Use a keyword research tool to check those URLs to see what they are ranking for. SEMRush is what I’m using.

- Shortlist again for the long-tail, most relevant keywords

Let’s say I want to rank for “no-code test automation software”. Here’s what I get when I type that into Google:

Here’s what I see:

- Reddit is dominant, which makes sense. Google wants to surface opinions from the community.

- The rest of the results are listicles talking about the top no-code/codeless automation testing tools.

-> Listicles are certainly effective for this type of query.

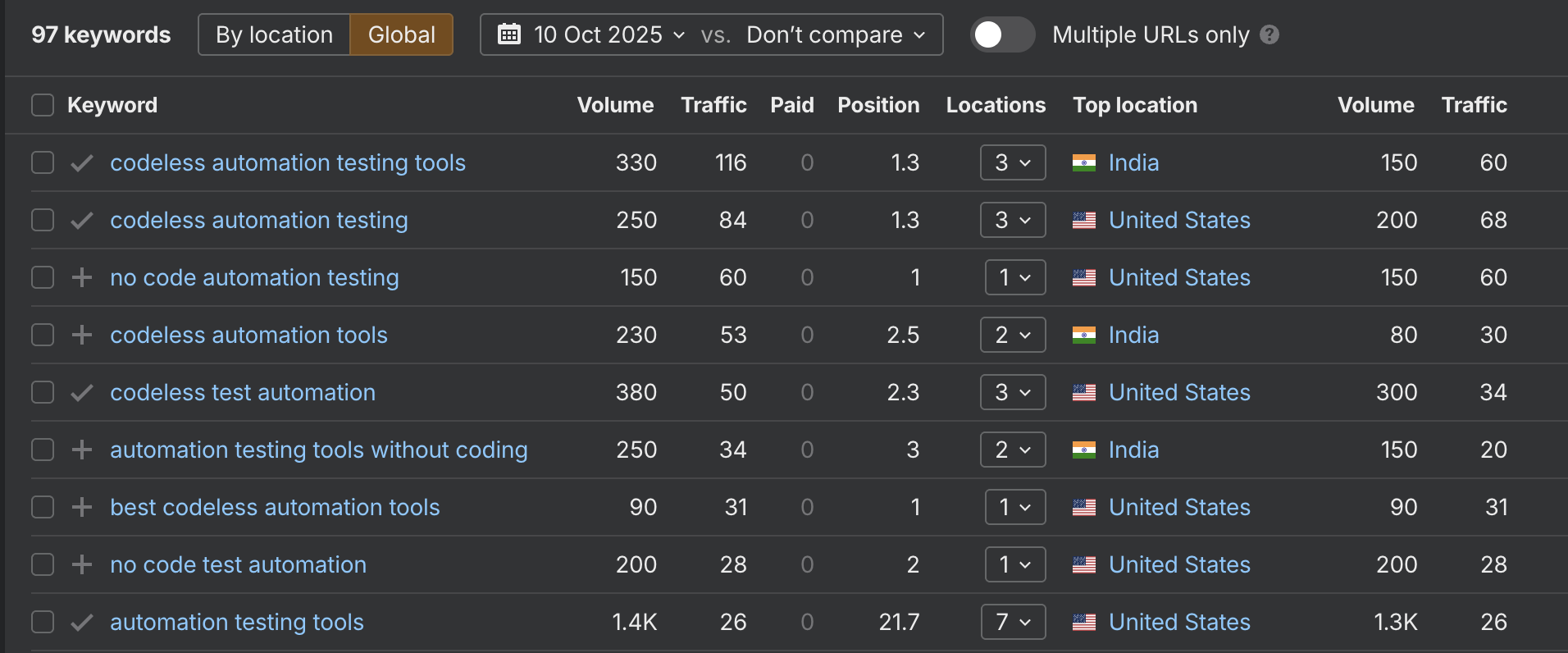

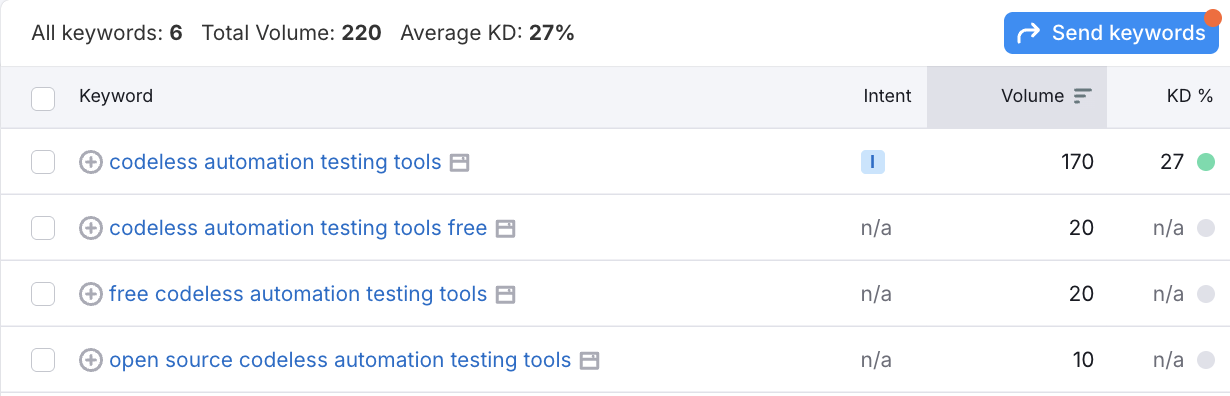

After that, I take the 2nd result from BugBug and plug it into Ahrefs. As of Oct 2025, they are ranking pretty high for “codeless automation testing tools”, whose volume is 330.

I plug “codeless automation testing tools” once again into SEMRush to cross-check, and it’s immediately visible that this is a really good keyword in terms of both volume and difficulty.

I add “codeless automation testing tools” into my keyword list, and the cycle repeats for the rest of the pain points.

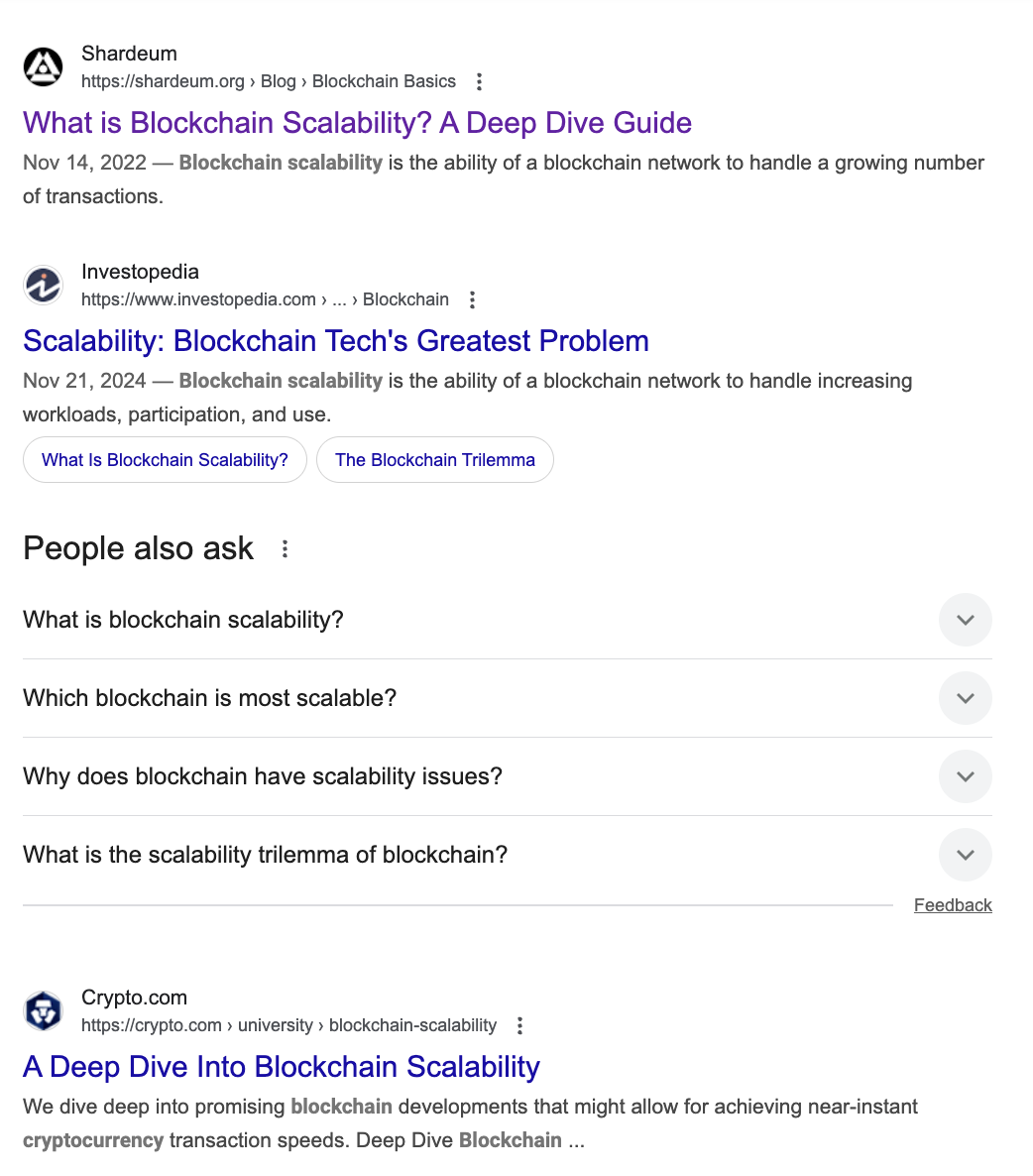

This approach is particularly helpful when the niche is too…niche. Say, I want to do keyword research for a niche called “blockchain scalability”. I’d also go on Google, type in the keyword, shortlist the domains, then plug them into Ahrefs.

Here I filter the keywords of Shaderum by “How to” keywords, which gives me some pretty decent JTBD keywords as starting points. I can then rinse and repeat the process, jumping between Google and keyword research tools to find the ultimate keyword list.

How to include Reddit in your B2B keyword research?

I see there are two caveats with keyword research tools:

- Their metrics are merely estimates. Keyword difficult is just an internal metric that these tools calculate based on their own idea of how Google works. Sometimes a low-difficulty keyword is not that easy to rank for.

- These tools don’t capture the entire search world. There are so many long-tail, conversational queries that these tools are missing, but they are certainly searched for on a daily basis.

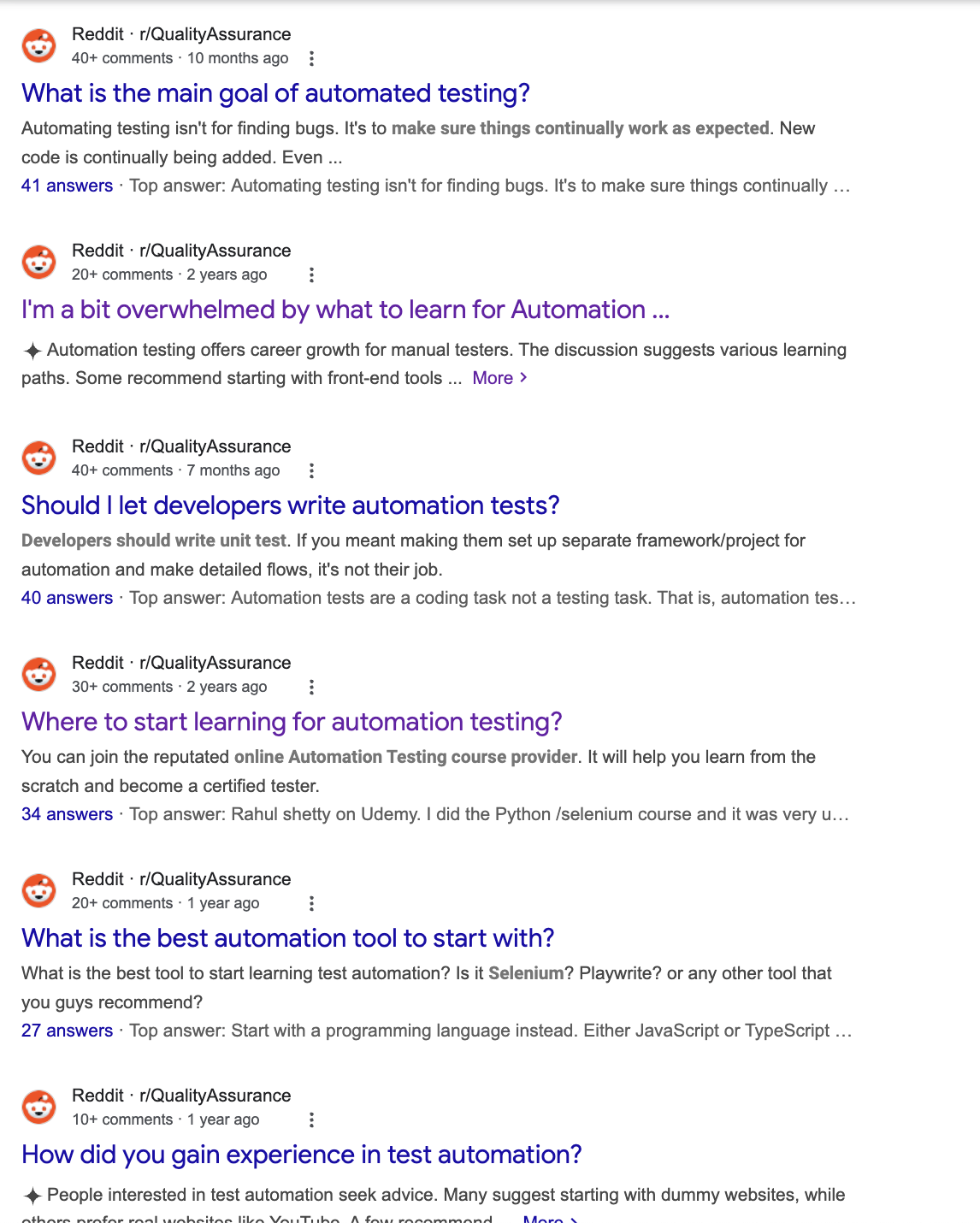

That’s why you need to go one step further and do what I call “community research”, and Reddit is perfect for this type of research.

In fact, everybody is adding “reddit” to their search queries these days. Therefore, you should try doing some “Reddit keyword research” to uncover what people are actually searching for. They have so many threads on comparisons, questions, edge cases and contextual nuances that don’t show up in keyword tools.

Let’s say I’m doing keyword research to write an article on “automation testing”. I’m going to type in Google:

site:reddit.com automation testing

And here is what people are actually searching for when it comes to automation testing:

You can also search around for some forums/communities on automation testing, then use the same parameter of site:[domain] automation testing to uncover actual conversations that you can write content about.

You can try using the keyword research process I laid out above to see if there are actual keywords to target or not. If yes, great; if not, categorize these content into the Publication folder.

Further reading: My approach to using Reddit for content research

Conclusion

Congratulations! You now know how to do B2B keyword research.

This is the very same process that I’ve been using to help my B2B clients develop their successful content marketing strategy, so you know that it has been thoroughly tested.

Partner with B2B SEO specialists who know keyword research, and more!

Welcome to Perceptric, where you’ll get the best-in-class:

- We understand your product (we’ll work with your internal team to make sure our content strategy strikes!)

- Revenue-driven SEO strategy tailored for the tech industries

- Expert-written content to build trust with your audience

- Conversion tracking configuration for your favorite CRM