Banking technology marketing isn’t just about explaining features to an audience swimming in legacy systems.

From understanding banking workflows and regulatory nuance to messaging, creative development, and multichannel execution, there is a ton of work behind the scenes to bring effective banking technology marketing to life.

What if you’re ready to scale your banking technology marketing but don’t have the time, expertise, or humanpower to translate features into outcomes for bankers on your own?

Well, good news: partnering with a good Banking technology marketing agency can be the solution for you!

But here’s the catch: while there are loads of Banking technology marketing agencies to choose from, the genuinely good ones are few and far in between.

To help you cut through the noise, we’ve compiled this list of the best Banking technology marketing agencies.

How I Choose The Best Banking Technology Marketing Agencies?

I have only one single principle: look at the way that agency markets itself.

I personally believe that the way a banking technology marketing agency describes its own value is often a good sign of how it will communicate in a complex, regulated environment. When the agency’s own message is structured, client work tends to mirror that.

TL;DR – What to look for when shortlisting your Banking technology marketing agency:

- Do they walk their talk? Is their own content as strategic as they promise to deliver?

- Is the writing actually good? Not just SEO-optimized, but human, specific, and informed.

- Is the voice consistent and intentional? Or does it feel templated or generic?

- Do the topics signal expertise? Are they saying something new, or just chasing keywords?

- Does their content serve a business purpose? Or is it just filler to look “active”?

Also, to fully reap the rewards of partnering with a Banking technology marketing agency, you’ll need to choose one that best aligns with your needs and goals.

For instance, some agencies are full-service partners while others are production focused. Likewise, some of them specialize in SEO-focused content while others lean towards thought leadership.

The Best Banking Technology Marketing Agencies

Here’s the list of 9 best agencies that I will cover in this article:

- Perceptric (Best for banking tech positioning and enterprise buyer trust)

- Concurate (Best for case-study-driven banking tech thought leadership.)

- Skale (Best for SEO-driven growth for fintech and banking solutions.)

- NoGood (Best for fast-testing paid programs in banking tech.)

- Kalungi (Best for GTM frameworks for complex fintech banking products.)

- Refine Labs (Best for demand acceleration in revenue-focused fintech orgs.)

- PR Lab (Best for PR and messaging tuned for regulated categories.)

- Bay Leaf Digital (Best for data-backed content for fintech banking solutions.)

- SimpleTiger (Best for fintech-first SEO and content optimization.)

1. Perceptric (Best for banking tech positioning and enterprise buyer trust)

Okay, since I’m writing this article, this is going to be quite a self-promo, but let me show you what makes Perceptric the right choice for you. Perceptric is an SEO/content marketing agency that help B2B technical products and services (fintech, retail tech, HR tech, health tech, manufacturing, and beyond) to build content engines that drive measurable business results.

How Perceptric approaches Banking technology marketing differently?

I use what I call the Knowledge-Narrative model. It’s the same approach you’ll see behind the strongest content programs out there like HubSpot, Notion, and a handful of other brands that consistently communicate with clarity and confidence. And it’s the exact playbook I use for our clients, as well as for Perceptric’s own content.

The idea is simple:

- Knowledge content gives your audience the “how”, with frameworks, explanations, practical breakdowns. This is the content that actually ranks on Google and gets people coming to your site in the first place.

- Narrative content gives them the “why”, with the perspective, the point of view, the bigger picture that makes the work feel meaningful and relevant. This is the content that sets your brand apart and gives people a reason to return to your site.

When the two come together and the writing is tight, you get the best of both worlds:

| Model | Pros | Cons |

|---|---|---|

| Knowledge |

– Drives consistent SEO traffic – Evergreen content compounds over time – Great for product education and acquisition – Scales well with small teams |

– Slower to show results – Less engaging on social – Can feel impersonal without human voice – Requires keyword research and SEO rigor |

| Narrative |

– Builds brand voice and trust – Great for social and email engagement – Flexible and timely – Showcases thought leadership and POV |

– Needs strong distribution – Less SEO value over time – Content decays quickly – Harder to scale without a team or audience |

Perceptric also follows several key principles when creating content:

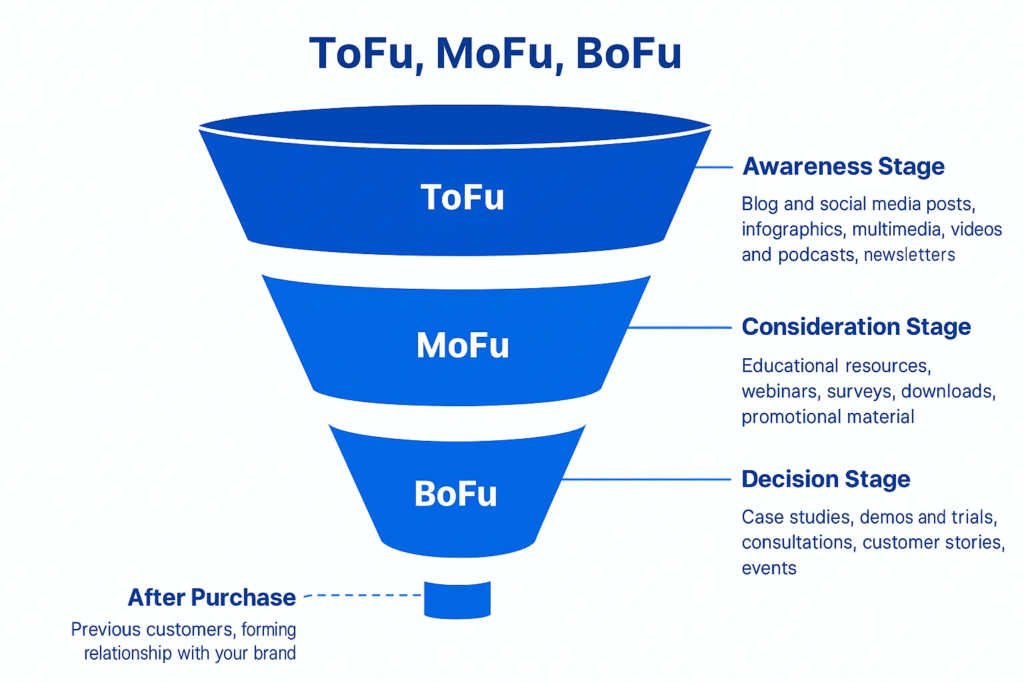

1. We start at the bottom of the funnel

When someone is at the bottom of the funnel, they’re already comparing options and trying to make a decision. If you show up here with clear, helpful content, you meet people at the exact moment they’re looking for you.

If you’ve ever watched a deal stall because a prospect didn’t understand something, you know the pain. We create content at the bottom-funnel stage to do the heavy lifting for you: answering objections, clarifying differentiation, showing outcomes, making the “why you” much clearer.

And when you publish this kind of content, sales teams feel the impact right away.

Instead of basic, beginner-level guides, think of articles like:

- [Your product] vs [Your competitor]: Why your product is superior

- [Competitor 1] vs [Competitor 2]: Which is better, and why your product is better than both

- How to [solve a problem with your product]

- Thought leadership article that shows why you’re disrupting the market

These are the types of content that gets shared in dark socials (private Slack channels,LinkedIn messages, tool discussion meetings, etc.).

2. We build opinionated, expert-led thought leadership banking technology content

We know that AI is the hot topic, but let’s face it, we don’t want to read an article that’s regurgitated by a machine. We only connect with content that takes a bold stance, that has a personality, that has a perspective that challenges what you always think.

For example, one of the article that Perceptric has on our blog is “Why you must go beyond SEO in content marketing?“. It’s the kind of article that asks a real question and makes you think twice. In fact, it’s one of the key articles that has influenced a lot of our clients’ final decision to work with us.

We believe that thought leadership shouldn’t be “big words, big ideas”. Thought leadership can be embedded everywhere in your content, you just need to know how to extract ideas for thought leadership content.

3. We bring you a team of technical experts

Our team is more than equipped to help you with B2B content writing:

- Our writers come from real technical backgrounds, through training, experience, or both, so we can produce content that advanced users actually trust.

- We take time to understand your product by talking to your team and customers, watching demos, reading docs, and trying the product ourselves.

- We bring your technical stakeholders into the process just enough to keep them comfortable and confident in the content, without taking too much of their time.

- You get a team that can scale smoothly, adjust to changes on either side, and keep the work moving without interruptions.

- You can start quickly because our team is already set up, aligned, and ready to deliver real results within the first month.

So, if you’re looking for a strategic B2B content partner that aligns with pipeline goals, Perceptric belongs at the top of your list. Here are the results we will measure for you:

- Landing high-value clients and contracts through inbound requests

- Generating leads or MQLs attributable to content published

- Increasing the number of sign-ups or other conversion events

- Increasing revenue

If you want a DIY guide (or you want to check how we approach SEO/content marketing for banking technology), here are some articles we produced:

2. Concurate (Best for case-study-driven banking tech thought leadership.)

Concurate is a banking tech storytelling agency that turns complex workflows into relatable, case-study-driven stories. They create warm, human narratives, not dense technical explanations.

Services offered: Case-study content, storytelling assets, B2B messaging support

What makes them stand out: Their content emphasizes detailed customer stories that show real banking and fintech outcomes.

Concurate pricing: Concurate is unusually explicit in interviews and comparisons. They mention typical ongoing partnerships landing around $5,000 to $7,500 per month, with smaller one off projects roughly from $3,500. That gives you a realistic starting range if you want editorial heavy B2B content without jumping straight to enterprise pricing.

It’s a great fit for: Bootstrapped and growth-stage SaaS companies wanting founder-led stories and product-led content turned into a repeatable pipeline asset.

Perhaps not a great fit if: You want a large content production engine rather than SME-led editorial built from interviews.

Website: Concurate

3. Skale (Best for SEO-driven growth for fintech and banking solutions.)

Skale is a banking-tech SEO agency that targets competitive financial keywords with precision. They focus on high-intent terms, not broad traffic plays.

Services offered: SaaS SEO, demand-gen alignment, technical improvements

What makes them stand out: Their SEO programs target competitive financial tech terms that matter for enterprise evaluations.

Skale pricing: SaaS SEO projects here typically start around $5,000, with everything else custom. Realistically, the minimum meaningful engagement ends up being a low five-figure quarterly commitment, especially once you layer links and content.

It’s a great fit for: Companies seeking SEO-focused content that moves rankings fast in competitive B2B niches.

Perhaps not a great fit if: You need high-volume content output rather than editorially polished, multi-format content.

Website: Skale

4. NoGood (Best for fast-testing paid programs in banking tech.)

NoGood is a growth experimentation agency that validates banking-tech messaging quickly. They prioritize rapid testing, not slow traditional cycles.

Services offered: Growth sprints, CRO, multi-channel experimentation

What makes them stand out: Their growth sprints help banking tech companies test messaging and channels quickly without heavy spend.

NoGood pricing: NoGood quotes growth retainers custom, and no public pricing menu exists.

It’s a great fit for: High-growth teams needing experimentation-heavy growth marketing and paid acquisition optimization.

Perhaps not a great fit if: You need steady execution work rather than rapid iteration, testing, and performance-driven experiments.

Website: NoGood

5. Kalungi (Best for GTM frameworks for complex fintech banking products.)

Kalungi is a fractional CMO GTM agency that sets up structured marketing foundations for banking-tech companies. They give you ICP clarity and funnel organization, not scattered activities.

Services offered: Fractional CMO support, full GTM buildout, demand-gen systems

What makes them stand out: Their fractional CMO model helps banking tech companies build GTM foundations from zero to scalable.

Kalungi pricing: This one is expensive. Their fractional CMO team model starts around $45,000/month, and performance-based elements stack on top. Definitely an enterprise-budget partner.

It’s a great fit for: Fintech and finance-related brands wanting growth strategy, funnel optimization, and marketing operations.

Perhaps not a great fit if: You want predictable SEO output without the long-term commitment required for meaningful ranking impact.

Website: Kalungi

6. Refine Labs (Best for demand acceleration in revenue-focused fintech orgs.)

Refine Labs is a demand-creation agency that helps banking-tech teams generate interest through education. They focus on category understanding, not gated lead magnets.

Services offered: Demand-gen experiments, revenue operations, paid acquisition

What makes them stand out: Their demand-gen programs help banking tech companies focus on revenue-producing channels instead of vanity metrics.

Refine Labs pricing: Refine Labs is one of the few that actually shares ballpark numbers. Strategy engagements sit around $35,000 as a one off, and full funnel customer generation programs start roughly at $31,000 per month. Paid media and lighter scopes are closer to $20,000 per month and up, depending on channels.

It’s a great fit for: B2B SaaS companies that want to redesign demand gen around revenue, not leads, with strategy, experimentation, and ops the internal team can own.

Perhaps not a great fit if: You want an execution shop rather than a strategic demand-generation framework centered on revenue.

Website: Refine Labs

7. PR Lab (Best for PR and messaging tuned for regulated categories.)

PR Lab is a fintech and banking-tech PR agency that secures analyst and media trust for complex products. They emphasize credibility, not generic exposure.

Services offered: PR strategy, media outreach, credibility building

What makes them stand out: Their PR team secures coverage that builds trust with financial press and regulated-audience publications.

PR Lab pricing: Pricing is totally closed off here. They position themselves heavily around PR and thought leadership, but there’s no public hint of retainers or minimums. It’s safe to assume PR-style budgets and get the exact number only after a discovery call.

It’s a great fit for: Startups and scale-ups wanting proactive PR, credibility building, and consistent media coverage.

Perhaps not a great fit if: You require generalist content support rather than technical, developer-level writing.

Website: PR Lab

8. Bay Leaf Digital (Best for data-backed content for fintech banking solutions.)

Bay Leaf Digital is a SaaS and fintech content agency that produces steady, analytics-backed content to support discovery and evaluation. They provide clarity, not filler.

Services offered: SaaS SEO, analytics-driven insights, content optimization

What makes them stand out: Their content and analytics help banking tech brands simplify complex financial workflows for buyers.

Bay Leaf Digital pricing: Bay Leaf Digital discloses some clues in interviews and directories. Typical ongoing SaaS marketing retainers tend to fall between $5,000 and $15,000 per month depending on funnel ownership and content workload. They shape pricing entirely around the scope you choose.

It’s a great fit for: SaaS companies wanting demand generation, SEO, paid media, and analytics programs built specifically for subscription-based models.

Perhaps not a great fit if: You need multichannel B2C support rather than SaaS-specific demand generation.

Website: Bay Leaf Digital

9. SimpleTiger (Best for fintech-first SEO and content optimization.)

SimpleTiger is a disciplined SEO agency that helps banking-tech companies capture enterprise search demand. They deliver straightforward prioritization, not overbuilt SEO frameworks.

Services offered: SaaS-focused SEO, content strategy, technical optimization

What makes them stand out: Their SEO execution helps banking tech companies rank for commercial, comparison, and integration-focused searches.

SimpleTiger pricing: SimpleTiger keeps pricing custom and does not show any specific starting amount publicly.

It’s a great fit for: SaaS brands that want focused SEO content strategy built for quick momentum in competitive markets.

Perhaps not a great fit if: You’re seeking a full creative studio rather than an SEO-led content and growth shop.

Website: SimpleTiger

Why should you hire a Banking Technology marketing agency?

Working with a banking technology marketing agency can be a rewarding investment for any business that wants to communicate compliance-ready solutions and win trust with financial institutions.

The right banking technology marketing agency can help you communicate compliance-ready value propositions and reach financial institutions evaluating new solutions.

Here are some of the top reasons to partner with a Banking technology marketing agency:

Reason #1: You have too much on your plate already

Even if you’re a banking technology marketing expert, there are only so many hours in a day. Explaining complex solutions and producing accurate, compliance-aligned content demands significant time. And once assets are created, you still need someone to distribute them across the right industry channels.

Reason #2: You want access to specialized expertise

A banking technology marketing agency brings professionals who understand the intricacies of financial software and its buyers. Partnering with an agency gives you access to specialists who create targeted content tailored to banks and financial institutions.

Reason #3: You care about long-term growth

You might expect a claim that banking technology marketing speeds up adoption quickly. Banking audiences rarely react that fast. Growth emerges when you commit to clarity, consistency, and patient trust-building in a conservative, highly regulated space.

Does content marketing work for banking technology companies?

Yes, in banking technology, content marketing is actually one of the highest-ROI levers available. Fintech and banking-tech buyers are cautious, research-driven, and slow to trust vendors. Content is one of the few scalable ways to shorten that trust gap.

When ACVs hit $50k–$500k+, even a handful of content-generated opportunities justify the entire investment in content marketing programs.

Partner with banking tech marketers who go beyond features

Looking for a full-stack banking technology marketing agency that is serious about driving growth? We’d love to chat about how we can help your business build a scalable growth strategy.

Let’s find out if Perceptric is the right agency for you. Let’s have a quick chat today!