In the wealth management world, trust and credibility is the core asset. If you don’t invest in strengthening your expertise in the market, it becomes hard for investors to even consider you, let alone reaching out and moving their money to you.

That’s why you need to do content marketing for your wealth management. Unlike short-lived ad campaigns, good content compounds over time. A well-structured piece of content can generate qualified leads for years and build authority in a crowded space where buying decisions are long and complex.

At Perceptric, we’re a content marketing agency that helps wealth management firms like yours create high-credibility content. Our work is designed to help you bring in new investors and establish your advisors as experts clients can rely on.

Based on my experience working for a wide variety of companies in the industry, I will share:

- What’s unique about content marketing for wealth management

- Our Knowledge-Narrative approach to content marketing

- How to do SEO content for wealth management

- How to do thought leadership content marketing for wealth management

Alright, let’s dive in!

Why does wealth management need content marketing?

Content marketing is the practice of informing and engaging potential customers through valuable digital content. The core idea is simple: teach, be open, build trust, and customers will naturally come to you when they’re ready to make a decision.

Online behavior has shifted, and today’s buyers prefer to research on their own before choosing a product or service. That’s why content marketing plays such a crucial role in digital customer acquisition: it supports people as they learn, compare, and build confidence, which gives them the knowledge they need to make informed decisions.

But do you really need content marketing? The answer is yes, very much so:

- More than any other industries, it’s incredibly important for content in wealth management to showcase expertise: People choosing a wealth manager look closely at your experience and approach, so your content has to clearly teach them how you help and why they can trust you. Strong, trustworthy content also helps you show up better on Google.

- Your content should either solve problems or be memorable: Content exists to clarify the financial concerns or life-planning problems your clients are dealing with, strengthening trust in your advisory process. It can also voice the investment philosophies your firm believes in, making your brand memorable to high-net-worth audiences.

- Good content is the only thing that ranks on Google: If you don’t create exceptional content, it’s hard to compete with the big fish. AI-generated content may sound like a good solution to create content at scale, but over a long enough period of time, people notice that you’re using AI, and they’ll lose trust in you. Besides, AI can’t write original content. Only humans can.

My approach to doing content marketing for wealth management

I use a very simple approach to content marketing for wealth management (and for virtually any other industry that my clients are in). It is called the Knowledge – Narrative approach.

Put simply, it’s about creating two types of content:

- Knowledge content, which answers questions and solves problems that your potential clients have. This type of content is usually optimized for SEO.

- Narrative content, which is basically just thought leadership content that showcases the philosophy and unique insights/POV that your brand believes in thanks to your experience in the industry. This type of content is meant to establish your brand as the expert.

A combination of both approach gives you the best of both worlds.

- Knowledge content brings in new audiences through SEO. Publication content keeps that audience engaged by showing thought leadership and perspective.

- Knowledge content is algorithm-friendly because it satisfies Google’s need for structure, clarity, and depth. Publication content is audience-friendly because it satisfies the reader’s need for voice and authenticity.

For wealth management, my Knowledge-style content can be topics like how asset allocation works and how to evaluate your risk tolerance, while my Publication content can be thought leadership on market behavior and commentary on long-term investing trends.

Examples of successful content marketing for wealth management

1. Wealthfront

Wealthfront’s content marketing revolves around deeply researched, SEO-optimized personal finance guides built for millennials and tech-savvy professionals who want to manage money without dealing with advisors. Their entire positioning is “automated, modern wealth-building,” and their content mirrors that: clear, transparent explanations of investing, saving, taxes, and long-term planning—without the jargon that traditional wealth firms use.

Wealthfront publishes high-intent educational content like “how much should I keep in cash,” “tax-loss harvesting explained,” and “how to build a long-term portfolio.” They also produce sophisticated calculators embedded in articles, and those tools pull people deeper into their product ecosystem. What sets them apart is how actionable and product-adjacent the content is: readers learn what to do, why it matters, and how the Wealthfront platform automates it.

2. XY Planning Network

XYPN is a network of fee-only financial advisors who specialize in younger, XY-generation clients. Their content is niche because they serve clients who don’t want legacy wealth management models and prefer a subscription-based financial planning.

Their content marketing centers on hyper-specific scenarios: paying down student loans while investing, optimizing a 401(k) match early in your career, planning for freelance/1099 taxes, saving during career transitions, and balancing retirement with lifestyle spending. They also publish advisor-led case studies about clients with nontraditional financial profiles like freelancers, tech workers, dual-income no-kids couples.

Most effective content marketing types for wealth management

Content marketing for wealth management works best when it’s built on a strong story: a real belief, a real point of view, or a real problem you’re trying to solve.

When that foundation is solid, every content format becomes effective, because they’re all expressing the same core idea in different ways.

With that said, here is my opinion on the types of content that you can use:

| Content Type | Ease of Getting Started | Time to ROI | Best Fit For |

|---|---|---|---|

| Short-form Blog Posts | Easy to write and publish. Great for quick wins and early traction. | Medium. Builds traffic over time, but can rank fast for long-tail keywords. | Brands needing fast educational content and SEO momentum. |

| Long-form Blog Posts | Harder to create. Requires depth, clarity, and expertise. | High long-term ROI. Ranks well, attracts high-intent traffic, builds authority. | Brands wanting strong SEO positioning and deep trust from readers. |

| Ebooks / PDFs | Medium difficulty. Requires structure and design, but highly doable. | High. Great for list-building and lead magnets with ongoing value. | Brands that need leads, gated content, or a strong reasons to subscribe. |

| Whitepapers | Hard. Requires expertise, research, and strong reasoning. | Very high for technical or regulated industries. Converts educated buyers. | B2B, technical markets, and companies selling high-ticket or complex products. |

| Short-form Videos | Easy to create today. Low production requirements. | Fast. Great reach with strong storytelling and consistency. | Brands with personality, compelling visuals, or educational angles. |

| Long-form Videos | Medium to hard. Requires planning, scripting, and editing. | Strong long-term ROI. Great for trust-building, demos, and depth. | Educators, experts, product-led companies, and brands needing explanation. |

| Case Studies | Medium. Requires customer coordination and storytelling. | Immediate to medium. High trust and high conversion impact. | Brands selling services, B2B tools, or anything high-ticket or relationship-based. |

| Infographics | Easy to medium. Requires design but delivers clarity fast. | Medium. Highly shareable and great for top-of-funnel visibility. | Brands with complex data, technical topics, or visual stories. |

| Thought Leadership Articles | Harder. Requires a strong point of view and real expertise. | High. Builds authority, recognition, and trust over time. | Executives, industry leaders, and brands shaping the direction of their category. |

Remember: all content types have potential, but you must be careful to not spread yourself too thin!

If your budget is in the nine figures, it’s a lot easier to run 2 podcasts, a video channel, a blog, and a magazine. But when you’re just starting out, focus on ONE channel that you believe to be able to deliver the best result, and double down when it starts gaining traction.

How to plan for content marketing in wealth management?

Most wealth management firms think content marketing just means posting articles on their blog. However, those pieces are usually built on generic research instead of real market insight, and often written by someone who isn’t an actual advisor.

So before you launch your content marketing campaign for wealth management, here’s what I recomend:

- Laser-focus into one content marketing channel and do it very well. Spreading yourself across too many channels wastes energy and leads to flat performance. Focusing on one or two allows you to create work that actually moves the needle.

- Start your content marketing strategy by targeting potential customers who are close to buying. Do not write content for keywords like “What is [XYZ]?”. You want to invite veterans and experts to your website, not beginners who don’t even know the meaning of a basic concept in your industry. Don’t chase the masses; instead try to find out what people at the purchase stage are searching for to solve their problems, then create content to show up and help them.

- Have a distribution strategy for every piece of content. Many wealth management firms create educational articles and hope investors will find them. For content to work, you need a clear plan to place it in front of the right audience — through LinkedIn, email newsletters, search, or advisor networks.

Further reading: A guide to B2B content marketing

1. Do audience research

Before you write content, make sure to conduct a good audience research. Audience research is simply the process of gathering and analyzing information about the people you want to reach with your marketing. It’s understanding your target audience’s motivations, pain points, and behaviors.

There are a lot of ways that you can do audience research to inform your content marketing activities:

- Talk to your Sales team — Yes, Sales people are literally in the trenches, so they know A LOT about your customers and what audience you attract. If you don’t talk to Sales to extract insights, you’re probably missing out.

- Social media discovery — Go to the social media channels and check out the posts and creators your audience follows to understand what they care about.

- Competitor analysis — Analyze competitors’ content, SEO, reviews, and digital presence to learn what resonates with your shared audience.

- Communities & forums — Lurk in Subreddits and online groups to hear unfiltered discussions and real pain points that people in your niche has. Reddit is especially useful because it has every communities imaginable on the planet, so you’ll probably find some subreddits talking about your field.

- Surveys & polls — Run short surveys or social polls to gather direct feedback at scale.

- Customer & prospect interviews — Talk directly with customers and ICPs to understand motivations and how they describe their problems.

- Search intent analysis — Study keywords, SERPs, and “People Also Ask” results to map what people are actually trying to solve.

- Website & content analytics — Use analytics and heatmaps to see how users behave on your site and what content truly performs.

2. Do keyword research

Once you have insights, it’s time to start keyword research. This should inform your content creation activities later.

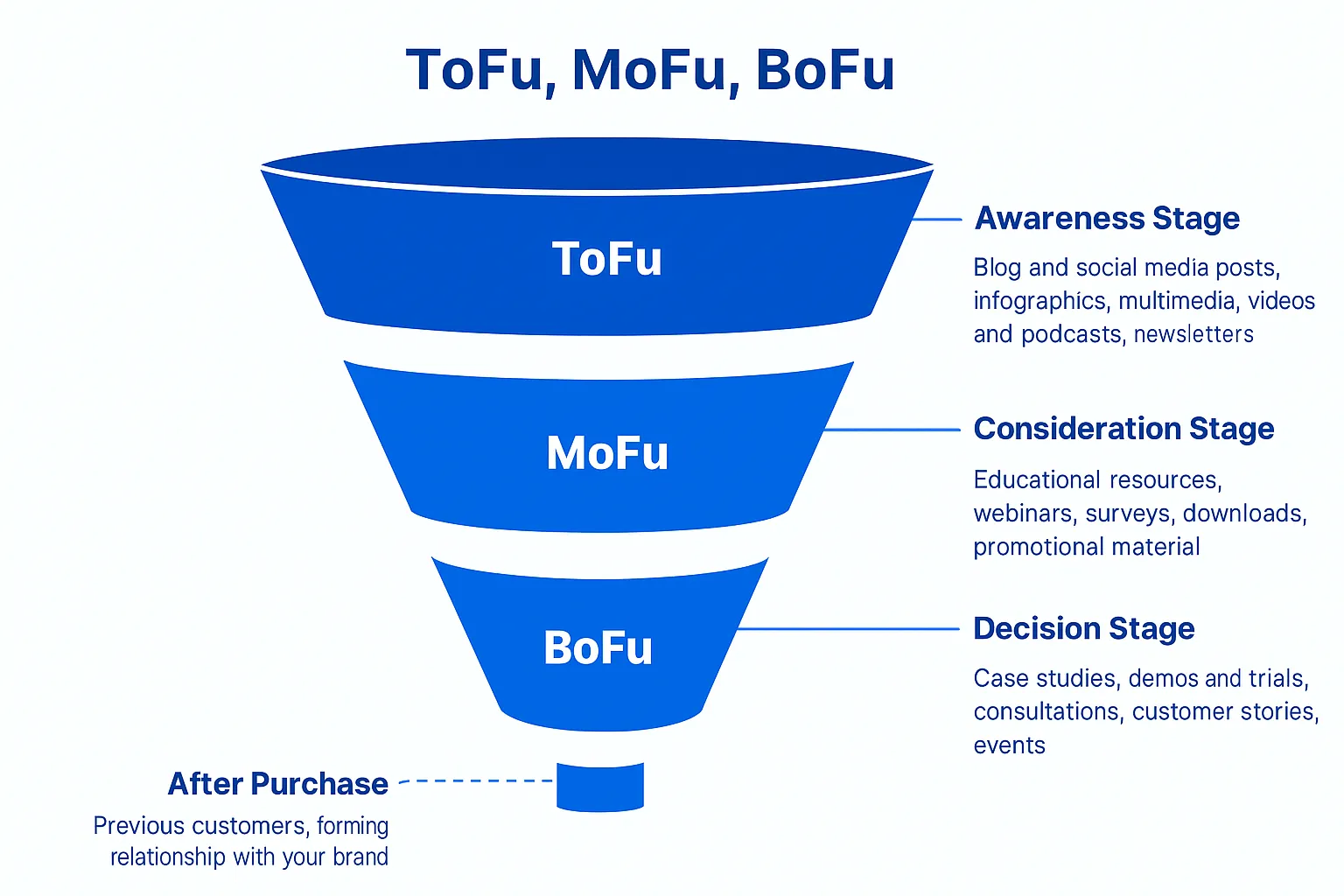

A lot of content marketers in wealth management start their content strategies by starting off at the “top” of the marketing funnel. In other words, they target people who are only looking for definition of a concept, not people actively looking for a solution. This often means creating broad, brand-awareness pieces on basics like “what is asset allocation” or “how does risk tolerance work.”

Anyone could be doing research on those generic terms. A grandma, a 10-year-old kid, a random college guy. it doesn’t necessarily guarantee they could become your customer.

Instead, you need to create content at the Bottom-of-the-funnel. That’s where the money lies. People searching for those terms usually know they are having a problem and are actively looking for a solution.

I categorize BOFU keywords into 3 major groups:

- Listicle Keywords – These are roundup-style searches like “Top 10 companies for [niche].” These attract users actively comparing options and help introduce your product/services as one of the contenders.

- Pain Point Keywords – These keywords are the real problems your audience is trying to solve, like “how to fix X” or “why Y happens.” Write a stellar article showing how to solve it, positioning you subtly as the ultimate choice to solve those problems. You can mine those keywords in forums and niche industry communities.

- Lead Magnet Keywords – Target people looking for resources with phrases like “free template for X” or “downloadable guide to Y.” These are great for capturing leads in exchange for helpful content. Build assets that directly match these needs.

Let’s say I am doing content marketing for a wealth management company called WriteMeContent, who provides retirement planning, here are the keywords I’m targeting for them:

- Listicle Keywords: best retirement planning services, top wealth advisors, best fiduciary planners

- Pain Point Keywords: how to choose a financial advisor, how to diversify retirement assets, why portfolios underperform

- Lead Magnet Keywords: retirement portfolio template, asset allocation worksheet, financial planning workbook

Once you’ve tapped out the pain-point and bottom-of-funnel keywords, you can move upward in the funnel and begin producing MOFU and TOFU content.

Further reading: B2B content marketing strategy checklist

How to write SEO content for wealth management?

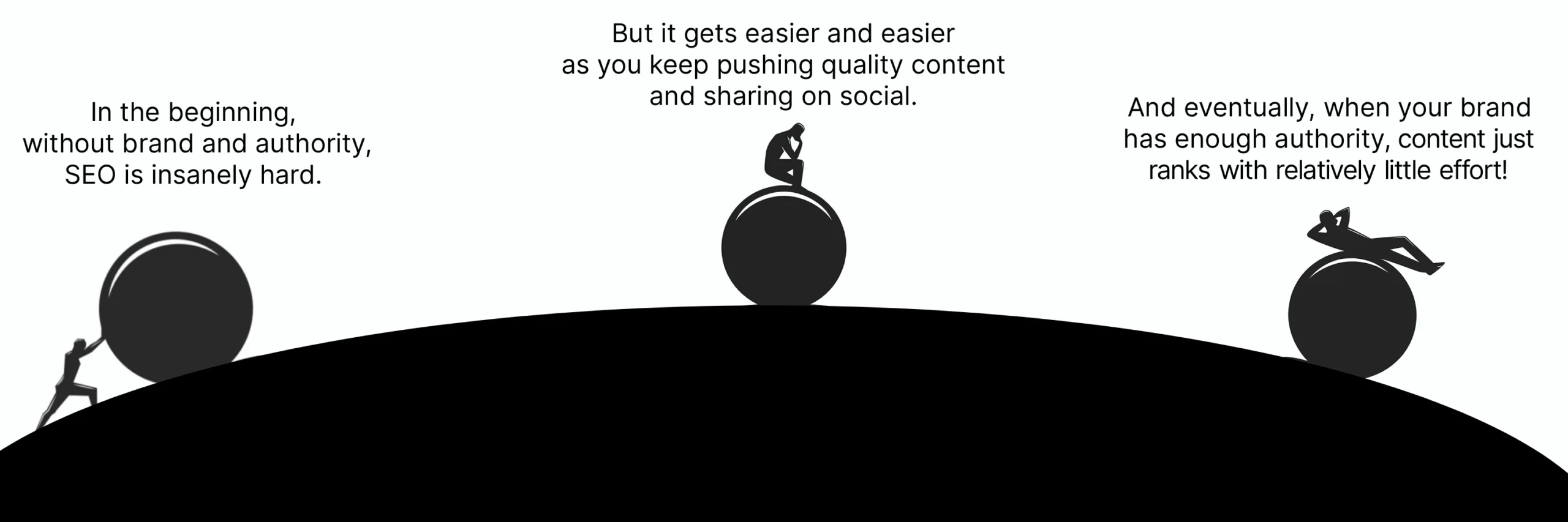

SEO content is amazing because it brings in consistent, evergreen traffic (and conversion) as long as you write content that genuinely resonates. Although it’s a relatively long-term game, the compound rewards are totally worth it!

My advice when choosing SEO as one of the content marketing channels for wealth management is that you should aim to publish the most trustworthy, experience-driven content available anywhere on your topic.

When someone turns to Google, they’re usually looking for guidance from people who’ve genuinely lived the experience. Most of the time, that means content written by real humans who know the topic firsthand.

But it might just as well be an AI-generated draft that’s factually sound and double-checked by a human. Google has openly said it isn’t concerned about whether a human or an AI wrote the content (at least for now). And if you bring real experience to the table, readers with expertise can always tell.

And when you actually write good content:

- Readers stay on your page for longer (which boosts SEO)

- Readers share your content to their coworkers and make discussions (which affects final buying decision)

- Readers remember your brand, and will return to consume more content from you (more traffic!)

- Readers are interested enough to check your products and services (which also affects their buying decision)

Here are the steps I would do to write the best piece of content:

- Open an incognito window and Google the keyword to figure out the search intent. In other words, what types of pages are showing up in the top three results? Deep-dive into that page. I usually check the depth of those top articles (and where I can beat them).

- Next, build an outline with clear H1, H2, H3, and H4 headings. The H1 is your main title, the H2s are your primary sections, and everything below that becomes supporting subheadings.

- Use keyword research tools like Ahrefs to research additional keywords to work into your article and guide your on-page SEO.

- Then write your content. If your outline is solid, all you need to do is fill in each section. And make sure your intro pulls people in.

Here are some best practices I apply for writing SEO content:

- Keep your H1 title tag under 60 characters, ideally in the 56–58 range to avoid truncation and keep the headline tight.

- Write a meta description under 155 characters and include your exact target keyword somewhere in the copy for clarity and relevance.

- Set your URL slug to the exact keyword. Most CMSs auto-generate the slug from your full title, which is rarely ideal. Always edit it so the slug is clean, short, and keyword-only. I still can’t believe how often this has to be repeated to content teams.

- Use JPGs for images that don’t need transparency, and keep them under ~100 KB. Compress them or convert PNGs to JPGs using online tools. If they’re still too large, resize them. On Mac you go to Preview → Tools → Adjust Size → set width to ~1280 or ~1080 and let the height scale automatically.

- Add ALT tags to every image. This is essential for accessibility and helps screen readers describe visual elements to users with impaired vision.

- Save your thumbnail image as a JPG and name the file using your exact target keyword. This boosts your chances of appearing in Google Image Search. The same applies to every image you upload: use descriptive filenames, not random strings. File naming plays a bigger role in image search than most people realize.

For wealth management in particular, here are some of my recommendations:

- When you break down planning strategies using real-life scenarios, affluent readers immediately sense the authenticity behind your expertise.

- Long-form, educational guides tend to circulate within advisor networks because they make everyone involved look smarter.

How to write thought leadership content for wealth management

Real thought leadership comes from the ideas you share and the way you deliver them, whether you’re writing, presenting, teaching, or speaking. When it’s done well, it separates you from everyone else and gives people confidence that your perspective is something they should pay attention to.

Just remember that thought leadership doesn’t always come from bold, groundbreaking statements. You don’t need to push against the grain to earn credibility. A detailed look into an overlooked topic can deliver plenty of “hidden gem” value.

For example, here’s a thought leadership post from Noah Greenberg, CEO at Stacker. He’s just expressing his ideas in a very simple, even casual fashion, and yes, I would say that it is a piece of LinkedIn thought leadership content:

The problem is that in most companies the founders and senior leaders are sitting on a goldmine of sharp opinions, but almost none of it ever gets written down. These ideas stay locked in their head. Without a system to extract that knowledge and turn it into clear, compelling content, the company never actually produces real thought leadership.

Your in-house marketing team, unfortunately, are just executors, not subject matter experts. They can package the ideas, polish the writing, and publish the content. But they’re not the ones shaping the industry. They didn’t found the company. They aren’t defining the strategy. They didn’t build the product.

When creating thought leadership content for wealth management, you have several options:

- Ideas rooted in your company’s origin story and the problem you set out to solve

- Ideas shaped by your strategic positioning and worldview

- Insights drawn from the actual nuance of what you build or deliver

- Strong opinions informed by years in the industry

- Proprietary data and patterns no one else sees

- Case studies that reveal details only insiders would know

So here’s how I’ll do thought leadership content marketing for wealth management:

- Find your story: Almost every wealth management firm exists because the founders experienced firsthand how confusing, opaque, or misaligned traditional advisory models were. They wanted a better way to serve clients with clarity, transparency, and strategy. That’s their disruption story. Interview the founders and tell that story. Lay out the pain points that led them to start their company, and explain the unique solution they developed to solve those problems.

- Find smart people with unique insights: Sometimes it’s just the reality is that most companies don’t have that “groundbreaking” story. However, they usually have smart people in the company. In wealth management, senior advisors can explain subtle planning strategies, portfolio mechanics, or behavioral insights that don’t translate into templated advice and are unique to how their practice operates. Engage with them, and interview them to write an insightful piece of content. You’ll be surprised at how much content can be produced simply by talking to experts in the team.

- Produce proprietary data: In wealth management, advisors crave data on market patterns, retirement behaviors, and portfolio outcomes. But most don’t have the tools or time to analyze it themselves, so they rely on others who publish trustworthy numbers. Sharing your own data and insights instantly positions you as a leader in the space.

How to distribute your content?

After you produce content, you can’t expect people to find it by themselves. SEO naturally brings in traffic, of course, but you must be proactive about content distribution too.

Here are some of my favorite content distribution channels for wealth management:

- Your company blog: Always start here. Link your articles together to take visitors from one page to another. For example, in a generic How-to article, try linking it to your thought leadership content. That helps siphoning some traffic from an high-discoverability page (thanks to SEO) to a low-discoverability page (thought leadership).

- Newsletters: A newsletter is the BEST way to distribute content. In the beginning, building an email list can take a lot of time and effort, but over time, it becomes a powerful owned channel for promotional content. Some of the good newsletter platforms I recommend are beehiiv, MailerLite, Kit, and Substack.

- Social media: LinkedIn is usually the best platforms for wealth management content distribution. Simply break your articles into smaller snippets and share it on social media. However, you need to share it on personal accounts rather than company pages (people don’t really read information from a Company page).

Choosing the content marketing agency for wealth management

Okay, since I’m writing this article, this is going to be quite a self-promo. But Perceptric is born out of my deep understanding of what’s lacking in the way content marketing is done in many wealth management. I saw how:

- Pain point 1: Content team is too disconnected from the Sales team to effectively collaborate and create content that really drives Sales.

- Pain point 2: Content team doesn’t focus enough on Bottom-of-the-funnel queries and topics that drive revenue. They chase entry-level keywords that may bring in tons of traffic (but none of them have the pain point that your products/services are solving).

- Pain point 3: Content writers tend to have not enough subject matter knowledge to write content for such a highly technical field.

That’s why I create Perceptric to solve those pain points for content teams in wealth management. We’re committed to crafting exceptional content that rises above the noise.

Here’s how I do content marketing differently:

- I use the Knowledge – Narrative approach to balance between SEO and thought leadership content

- I focus on creating content for the bottom-of-the-funnel that answers very specific pain points that your customers are having.

- I also help you build thought-leader/opinion content pieces (sourced from experts in your field) that reflects what your brand believes in. Content marketing, at the highest level, becomes brand building itself.

- Finally, I help you distribute those content pieces by repurposing them into formats suitable for social media

If you’re looking for a content marketing partner who genuinely gets what it means to do marketing for wealth management, I’d love to help!

Wealth management marketing Frequently Asked Question

1. Why is content marketing important for wealth management?

Content marketing lets wealth management firms educate prospects before the first meeting. Transparent, helpful guidance builds confidence and nudges high-net-worth clients toward booking consultations or transferring assets. Trust is the differentiator.

2. What’s the biggest mistake wealth management make with content?

Many wealth management firms churn out generic market commentary and miss the content prospects truly need before hiring an advisor. Focus first on planning, taxes, and decision-driven queries—not broad awareness.

3. How should wealth management measure content marketing?

Beyond traffic and engagement, {Industry keywords} should track sales-related outcomes rather than vanity metrics like traffic. This includes:

- Number of leads generated

- Deals/conversions attributed to content

- Deals/conversions influenced by articles

4. What type of content works best for wealth management?

For wealth management, start with BOFU queries such as “fiduciary advisor near me” or “tax-efficient retirement planning.” After capturing conversion-ready traffic, broaden into planning guides and thought leadership.